All Categories

Featured

Table of Contents

Insurance provider will not pay a small. Rather, think about leaving the money to an estate or trust fund. For even more thorough details on life insurance obtain a duplicate of the NAIC Life Insurance Policy Customers Guide.

The internal revenue service positions a restriction on exactly how much money can enter into life insurance policy costs for the policy and exactly how rapidly such premiums can be paid in order for the plan to preserve every one of its tax obligation benefits. If certain restrictions are exceeded, a MEC results. MEC insurance holders might undergo tax obligations on circulations on an income-first basis, that is, to the level there is gain in their plans, in addition to fines on any kind of taxed amount if they are not age 59 1/2 or older.

Please note that outstanding loans accrue passion. Earnings tax-free therapy also presumes the financing will at some point be satisfied from earnings tax-free death benefit profits. Loans and withdrawals lower the policy's cash value and fatality advantage, might cause particular policy benefits or bikers to come to be not available and may boost the possibility the plan might lapse.

4 This is given via a Long-lasting Treatment Servicessm motorcyclist, which is readily available for an additional charge. Furthermore, there are constraints and restrictions. A customer may qualify for the life insurance policy, however not the rider. It is paid as an acceleration of the death benefit. A variable universal life insurance policy agreement is an agreement with the main function of giving a fatality advantage.

Who offers flexible Final Expense plans?

These profiles are carefully taken care of in order to please stated financial investment purposes. There are costs and fees related to variable life insurance policy agreements, including mortality and threat charges, a front-end lots, management charges, investment management charges, abandonment charges and charges for optional riders. Equitable Financial and its affiliates do not offer lawful or tax suggestions.

Whether you're starting a family or getting married, people generally start to think of life insurance policy when someone else starts to rely on their capacity to earn an earnings. And that's terrific, since that's specifically what the survivor benefit is for. As you learn much more concerning life insurance coverage, you're most likely to find that numerous plans for circumstances, entire life insurance coverage have greater than just a survivor benefit.

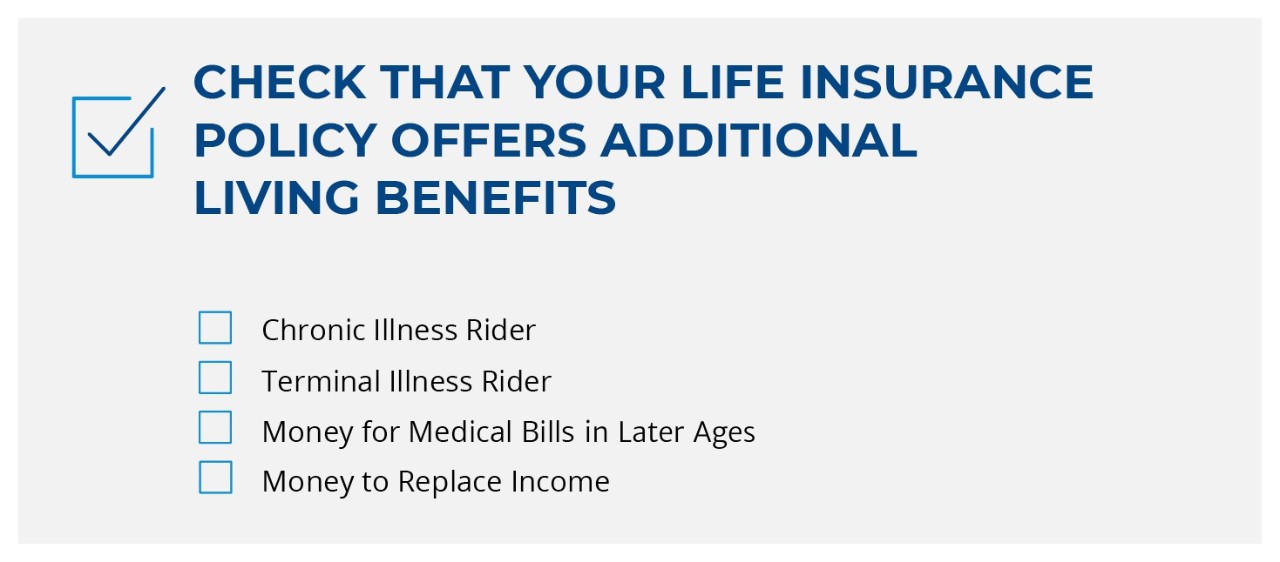

What are the advantages of whole life insurance policy? Right here are several of the vital points you ought to know. Among the most appealing advantages of purchasing an entire life insurance policy policy is this: As long as you pay your premiums, your survivor benefit will never ever run out. It is guaranteed to be paid regardless of when you die, whether that's tomorrow, in 5 years, 80 years and even better away. Riders.

Think you do not require life insurance policy if you do not have youngsters? You may wish to reconsider. It might appear like an unnecessary expense. There are many benefits to having life insurance coverage, even if you're not sustaining a household. Below are 5 reasons that you need to acquire life insurance policy.

Legacy Planning

Funeral costs, funeral prices and clinical bills can accumulate (Life insurance). The last thing you want is for your loved ones to bear this extra burden. Long-term life insurance policy is offered in various amounts, so you can choose a survivor benefit that meets your requirements. Alright, this only applies if you have youngsters.

Figure out whether term or long-term life insurance policy is best for you. Get a quote of just how much protection you might require, and just how much it could cost. Find the appropriate amount for your budget and assurance. Discover your quantity. As your individual situations change (i.e., marital relationship, birth of a kid or job promo), so will certainly your life insurance policy requires.

For the a lot of part, there are 2 sorts of life insurance policy prepares - either term or irreversible strategies or some mix of the 2. Life insurers use different forms of term plans and traditional life policies in addition to "passion delicate" items which have actually ended up being extra widespread given that the 1980's.

Term insurance coverage provides defense for a given amount of time. This duration can be as short as one year or provide protection for a certain number of years such as 5, 10, twenty years or to a specified age such as 80 or in some instances up to the earliest age in the life insurance policy mortality tables.

Can I get Life Insurance online?

Presently term insurance coverage prices are really competitive and amongst the most affordable traditionally experienced. It needs to be noted that it is an extensively held belief that term insurance coverage is the least costly pure life insurance protection offered. One requires to review the policy terms thoroughly to determine which term life alternatives are suitable to meet your specific conditions.

With each brand-new term the premium is enhanced. The right to restore the policy without proof of insurability is an essential benefit to you. Or else, the risk you take is that your health and wellness might degrade and you may be incapable to get a plan at the very same prices and even in any way, leaving you and your recipients without coverage.

You should exercise this choice throughout the conversion duration. The length of the conversion period will certainly vary relying on the type of term plan purchased. If you transform within the recommended duration, you are not required to provide any kind of info regarding your health and wellness. The premium price you pay on conversion is normally based upon your "present achieved age", which is your age on the conversion day.

Under a level term policy the face amount of the plan continues to be the exact same for the whole duration. Usually such plans are sold as home loan security with the amount of insurance lowering as the balance of the home mortgage lowers.

Who offers flexible Whole Life Insurance plans?

Traditionally, insurers have actually not had the right to alter costs after the policy is sold. Because such policies might proceed for numerous years, insurers need to make use of traditional mortality, passion and expenditure rate estimates in the premium calculation. Adjustable costs insurance, however, permits insurance firms to use insurance coverage at reduced "present" premiums based upon less conservative assumptions with the right to alter these premiums in the future.

While term insurance is created to give defense for a defined time period, long-term insurance policy is created to give coverage for your whole lifetime. To keep the premium price degree, the premium at the younger ages exceeds the real price of defense. This added costs develops a get (cash worth) which assists spend for the policy in later years as the price of protection increases over the costs.

Under some policies, costs are called for to be spent for a set number of years. Under various other plans, premiums are paid throughout the insurance holder's lifetime. The insurer spends the excess costs dollars This sort of policy, which is sometimes called cash worth life insurance policy, creates a cost savings element. Cash worths are essential to a permanent life insurance policy plan.

Table of Contents

Latest Posts

Burial Insurance Ny

Universal Life Insurance Instant Quote

1 Life Funeral Plan

More

Latest Posts

Burial Insurance Ny

Universal Life Insurance Instant Quote

1 Life Funeral Plan