All Categories

Featured

Table of Contents

Adolescent insurance policy offers a minimum of protection and can supply protection, which might not be available at a later date. Amounts provided under such insurance coverage are usually limited based on the age of the youngster. The current constraints for minors under the age of 14.5 would be the higher of $50,000 or 50% of the amount of life insurance policy effective upon the life of the candidate.

Adolescent insurance policy might be sold with a payor advantage rider, which offers waiving future costs on the kid's plan in the event of the death of the individual that pays the costs. Elderly life insurance policy, occasionally referred to as rated death benefit strategies, provides qualified older candidates with very little whole life protection without a medical checkup.

The permissible concern ages for this kind of insurance coverage range from ages 50 75. The optimum problem quantity of insurance coverage is $25,000. These plans are usually a lot more costly than a completely underwritten plan if the person certifies as a standard danger. This kind of insurance coverage is for a small face amount, generally acquired to pay the interment costs of the guaranteed.

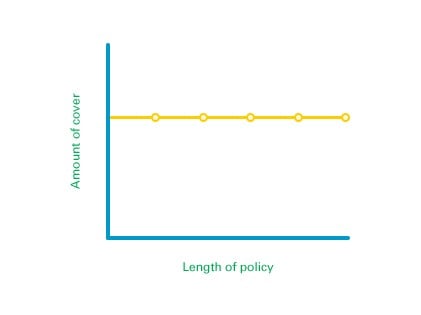

Our term life options include 10, 15, 20, 25, 30, 35, and 40-year plans. The most popular type is level term, meaning your payment (premium) and payment (survivor benefit) remains level, or the exact same, until completion of the term duration. This is the most simple of life insurance alternatives and calls for really little maintenance for plan proprietors.

What is included in Level Term Life Insurance coverage?

You can give 50% to your spouse and split the rest amongst your adult children, a parent, a pal, or also a charity. Level term life insurance benefits. * In some instances the survivor benefit might not be tax-free, learn when life insurance policy is taxed

1Term life insurance policy uses temporary security for a critical period of time and is generally less costly than irreversible life insurance. 2Term conversion standards and limitations, such as timing, might use; for instance, there may be a ten-year conversion opportunity for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance coverage Acquisition Option in New York City. 4Not readily available in every state. There is a cost to exercise this biker. Products and bikers are offered in approved territories and names and features might vary. 5Dividends are not guaranteed. Not all getting involved plan owners are qualified for dividends. For select bikers, the problem uses to the insured.

Who offers What Is Level Term Life Insurance??

We might be compensated if you click this ad. Whether you die on the very same day you take out a policy or the last, your recipients will certainly receive the same payout.

Plans can additionally last up until specified ages, which in most instances are 65. Beyond this surface-level information, having a better understanding of what these strategies require will certainly aid guarantee you purchase a policy that satisfies your demands.

Be mindful that the term you choose will influence the costs you pay for the plan. A 10-year level term life insurance policy will set you back less than a 30-year plan since there's much less opportunity of an occurrence while the plan is active. Reduced threat for the insurance company equates to reduce costs for the policyholder.

What Is Level Term Life Insurance?

Your family members's age should also affect your policy term selection. If you have children, a longer term makes good sense due to the fact that it secures them for a longer time. If your youngsters are near adulthood and will be financially independent in the close to future, a much shorter term might be a much better fit for you than an extensive one.

When comparing entire life insurance coverage vs. term life insurance coverage, it deserves noting that the last commonly expenses less than the previous. The outcome is extra insurance coverage with lower premiums, supplying the best of both worlds if you require a considerable quantity of protection however can not pay for a much more pricey plan.

How do I apply for Level Term Life Insurance For Seniors?

A level fatality advantage for a term plan generally pays out as a swelling amount. Some level term life insurance coverage firms enable fixed-period payments.

Rate of interest repayments got from life insurance coverage plans are thought about earnings and are subject to taxes. When your degree term life plan ends, a couple of different points can occur.

The drawback is that your eco-friendly degree term life insurance coverage will come with higher costs after its first expiration. We might be compensated if you click this ad.

What happens if I don’t have Level Term Life Insurance Protection?

Life insurance business have a formula for computing danger making use of death and passion. Insurance providers have countless clients getting term life plans simultaneously and utilize the costs from its active policies to pay enduring beneficiaries of various other plans. These business make use of mortality to estimate exactly how lots of people within a details group will file death claims each year, which information is utilized to determine typical life expectations for prospective insurance holders.

Furthermore, insurer can spend the cash they receive from costs and increase their income. Considering that a level term policy doesn't have cash money worth, as a policyholder, you can not spend these funds and they do not supply retirement revenue for you as they can with entire life insurance policy plans. The insurance coverage company can invest the money and make returns.

The following section information the benefits and drawbacks of degree term life insurance policy. Predictable costs and life insurance policy protection Streamlined policy framework Possible for conversion to permanent life insurance policy Restricted coverage duration No cash money value build-up Life insurance coverage costs can boost after the term You'll discover clear advantages when comparing degree term life insurance coverage to various other insurance policy types.

Who provides the best Level Term Life Insurance Quotes?

You constantly recognize what to expect with inexpensive level term life insurance policy coverage. From the moment you obtain a policy, your costs will certainly never ever change, assisting you intend financially. Your coverage won't differ either, making these policies effective for estate preparation. If you value predictability of your repayments and the payouts your beneficiaries will certainly obtain, this type of insurance coverage could be an excellent suitable for you.

If you go this course, your costs will enhance yet it's always great to have some versatility if you desire to maintain an energetic life insurance policy policy. Sustainable degree term life insurance policy is another option worth taking into consideration. These plans enable you to maintain your present plan after expiry, offering adaptability in the future.

Table of Contents

Latest Posts

Burial Insurance Ny

Universal Life Insurance Instant Quote

1 Life Funeral Plan

More

Latest Posts

Burial Insurance Ny

Universal Life Insurance Instant Quote

1 Life Funeral Plan